♫ Together together

Were winning together

Forever and ever

You’ll be remembered

For every little thing you do for me…♫

My latest – and lead article: “Winning the War for Talent While Improving Profitability” just released in American Bar Association’s Law Practice Magazine. Co-written with my friend Steven Campbell CPA CA. https://lnkd.in/drNezZQt Deep dive into law firm finance in the context of today’s environment.

Rules For Winning the War For Talent While Improving Profitability

Law firms are facing another year of unique challenges in 2022. The big three include:

- Associate recruiting, retention and compensation (including stay and year-end bonuses), compounded by firms adjusting to work/life balance resulting from associates working from home.

- Inflation and higher interest rates impacting a firm’s ability to raise rates to match or exceed inflation.

- Changing lawyer preferences resulting from ‘back to the office’ and hybrid working arrangements.

We review the profit drivers that Robert (“Bob”) Arndt discussed in his 1988 book: “Managing the Economic Levers” published by the Section of Economics of Law Practice, American Bar Association as Bob’s advice is as relevant today as then and provides guidance in today’s environment.

Bob broke down the business of law into five categories using an acronym that he called RULES:

R = rates

U = utilization

L = leverage

E = expenses

S = Speed

Traditionally law firms raised rates to increase profitability. However, Bob suggested there are other methods, such as:

- managing the client intake process (Bob considered this to be the most important point);

- tailoring rates and billing policies to specific clients and matters;

- managing rate and billing adjustments;

- billing often and keeping the client informed;

- tying partner reward structure to rate performance; and

- reporting rates achieved.

The business of law has changed since Bob first published his principles. We propose to build on the RULES principles by incorporating analytics and new approaches to matter management to provide ideas for improving profitability and client value in today’s environment.

Rates

There are four rates that firms should monitor to understand the impact of cash leakage on profits: Standard, Negotiated (Worked), Billed, and Collected. Understanding the factors behind each rate provides insights into minimizing ‘cash leakage’ (or the reduction from billable hours worked to realized amounts), thereby improving partner profits.

Standard Rates

A standard rate is an attorney’s quoted hourly billable rate. Standard rates are more aspirational than realistic: today’s profitability surveys ask about negotiated rates. Interestingly, following the Great Recession, firms discovered that many clients measured their negotiating success by the percent discount achieved to standard rates. Firms that did not increase standard rates learned that it put them at a price disadvantage for many years against firms that continued to increase standard rates annually. With inflation running around 8% in Q1 2022, many firms plan to increase their standard rates by 8 –10%.

Negotiated Rates (Worked Rate)

Negotiated rates are agreed to adjustments from standard rates, ideally reserved for large clients with good credit and payment histories. The average firm negotiates discounts from the standard by 7.7%. Be watchful for deeper discounts: for a firm with a 30% profit margin, each 1% adjustment reduces profit by 3%. When clients persist, evaluate whether an Alternative Fee Arrangement (AFA) or blended rate is appropriate. If a client’s discount is significantly below the firm average, it may be time to terminate the client and seek more profitable work.

Billed Rates (write-downs)

Downward adjustments can occur when the billing lawyer feels the time worked exceeds the value the client received or agreed to pay. The average firm discounts worked to billed rates by 8.2%.

Sidebar:

Poor supervision to original targets: Supervisors fail to monitor delegated work.

Inexperienced lawyers: Junior lawyers learning curve and time written off for training.

Staff turnover: New lawyers having to come up to speed.

Client Guidelines: Lawyers failing to comply with client guidelines.

Scope Creep: Poor client communication.

Collected Rates (write-offs)

Write-offs occur after an account is billed and the client is either unwilling or unable to pay the account. In 2021, partial or total account write-offs averaged 9.4%.

Sidebar

Sticker Shock: Insufficient discussion with client as to the expected fees. Risk of disrupting client relationship.

Poor credit risk: Clients onboarded without ability to pay.

Contingency fees: Time written off due to poor case assessment and / or risk sharing with client.

Billed too late: Client refuses to pay as billed beyond client guidelines.

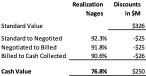

Accumulated Leaks

The amount of lost opportunity in this cycle is enormous. Assume a firm with a standard worked value of $326 million, and using the average realization deduction percentages noted above, we arrive at a net cash collection of $250M. As shown in the chart below, for every 1% improvement in realization, firm profit would increase by $3.26M.

Actions firms can take to improve realization

Working with an Am Law 200 firm during the Great Recession, when realization was dropping across the industry, we used informative analytics to help the firm improve the standard to cash collected realization by 4%.

When presented with analytics like the table above, partners were amazed at the impact of discounts they readily agreed to give previously. The partners embraced a new review procedure: all rate adjustments had to be centrally approved (in this case, by a retired partner). When clients asked for a discount, the partner could honestly say they did not have the authority to approve the request. If the client persisted, they were informed that their request had to be approved by a committee that reserved adjustments for extenuating circumstances.

The benefits of this system were:

1) it shielded the partner from being the person who had to say no; and

2) it ensured that discounts were reserved for legitimate reasons.

Further analysis revealed systemic issues that, once addressed, further improved realization. These included:

- Inconsistent standard rates: These were alleviated by implementing centrally set standard rates based on competitive rate information by practice, timekeeper seniority and geography.

- Improved and centralized client in-take process: Clients were vetted for creditworthiness, past billing, collection, and profit trends. Retainers were required for new clients.

- Improved matter intake process: All new matters required engagement letters that included the firm’s billing and collection policies.Partners were required to outline the scope and set fee budgets for all matters, proactively communicating and collaborating with clients.

- Enforced standard client arrangements as set out in the client’s SOP (Standard Operating Procedures): Clients were informed as to their fee and evergreen obligations.Time entry systems were programmed for alerts for time or expense entries inconsistent with the client SOP. This resulted in fewer pre-bill adjustments and audit exceptions, thereby speeding the time to

- Centralized contingency matter acceptance with enhanced risk assessment.

- Year-end discounts (thought to incentivize clients to pay accounts) were stopped.

Utilization

Utilization in the RULES context starts with the worked billable hours per timekeeper. The 2022 Report on the State of the Legal Market: average billable hours increased from 120 per month in 2020 to 124[1] in 2021; an annualized increase of 48 hours per timekeeper. It should be noted that 2021 results are still 120 hours per year lower than 2007, the year before the great recession.

Effective Capture & Timely Record All Time:

Studies show that when timekeepers record their activities, a significant amount of time goes unrecorded when worked in short durations, on mobiles, evenings, and weekends.

Software solutions contemporaneously capture all activities performed on most electronic devices, including email, texts, phone calls, and most computer software applications. Timekeepers can electronically review, amend, and submit these, capturing time that previously went unrecorded.

Based on a survey of users one year after we implemented such a system, we concluded that the firm captured 3.7%[2] more time, contributing an additional 11.1% profit.

The survey also concluded that the timekeepers spent 1.5% less time manually reconstructing and entering their time. Given current demand increases, this productivity gain could translate into billable hours without increasing the total number of hours that timekeepers work.

There are only so many hours in a day and most attorneys feel that they are giving all they have. But there are still metrics that a firm should monitor to help attorneys ensure that their efforts are being used as productively as possible. Some metrics are:

- Percent of billable time to total time recorded: Many of us know attorneys that are first in and last out but fail to achieve targets.This identifies those attorneys that may benefit from time management coaching.

- Uneven distribution of work: One firm introduced a Red Light / Green Light system. Attorneys choose a stoplight color from red to green, indicating how busy they expect to be in the coming week, month and quarter. New work assignments were given to lawyers with matching expertise and availability (and to those that asked for opportunities in new areas of law).

- Size of Clients: Analysis of major law firms indicates that attorneys working on smaller clients have lower billable hours.They experience small bursts of work for many clients instead of large blocks for attorneys working on more significant clients. This conclusion was drawn from a client segmentation profitability analysis.

- Freeze Hires: Based on a profitability study during the recession, a firm implemented a policy to freeze new hires for practices where total underutilization hours was greater than the equivalent hours of an FTE attorney.

Leverage

Leverage is the billable hours ratio of equity partners to other timekeepers and is one of the best drivers that lower rate firms can use to improve partner profits. Take Cole, Scott & Kissane, a 2nd 100 firm with 541 lawyers in Florida. The average profit per timekeeper was only $20K; yet the Profit per Equity Partner of $3.7M ranks it as one of Am Law’s 2020 survey’s most profitable firms. Cole achieved this result through high leverage. While leverage may not be a key factor for all practice areas, clients are increasingly seeing the value of delegating work to the least expensive, competent professional – thereby increasing leverage and profits through enhanced utilization of paralegals and other paraprofessionals.

Firms could use leverage to turn the war for talent from being money-driven to offering enhanced training and mentoring, a holistic sense of purpose, and a better work/life balance.

In the 2021 Above the Law Millennial Survey by Major, Lindsey & Africa, associates were asked what they would desire over increased salary. The results:

- 29% more time off,

- 25% flexible work schedule,

- 26% reduction in billable hours, and

- 8% more time for career, training, and development.

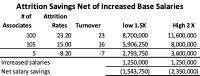

A Thomson Reuters survey indicates that associate turnover reached 23.2% in 2021 compared to 15% in 2020. Moreover, TR estimated that the turnover cost for an associate is 1.5 – 2 times annual salary. Based on an average 3rd year associate salary of $250,000, the cost to the firm would be $375,000- $500,000 per associate.

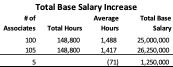

Let’s assume a firm with 100 associates working an average of 1,488 billable hours per year. If total associate hours remained the same and the firm hired five additional associates, then average associate hours would drop down to 1,417. By increasing leverage, the firm would have the opportunity to meet the associates’ priorities for fewer hours, flexibility, etc. and save costs over the long term. How? By cutting hours, a firm could potentially get to 2020 attrition rates, possibly lower. Assuming no salary reductions (and average salary noted above), the net savings from lower turnover ($1.5M-$2.4M) would more than pay for the compensation of the additional associates ($1.25M), as shown in the chart below.

If a firm were to follow this recommendation of increasing leverage AND addressing associates’ priorities for reduced hours, flexibility, professional development, etc, they would almost certainly improve associate satisfaction and retention. In ‘Practice What You Preach’, David Maister’s survey results found a causal relationship between employee satisfaction and profit, where a 10% satisfaction improvement causes a 25% increase in firm profit.

Expenses

Most expenses, other than rent, are expected to increase with inflation in 2022. If firms can increase negotiated rates equal to inflation, then partner profits will increase at the inflation rate. Further Net Income Profit margin improvement will come to firms that reduce their space footprint; as rent is the largest expense following salaries, those gains could be significant.

Speed

Speed refers to the time lag from the date work is done to when payment is received. Work in Process is time worked by not billed and Accounts Receivable is time that has been billed but not yet paid. WIP+AR = ‘lock up’. According to a recent PwC survey in the average firm, Lock-Up = 115 days.

One firm reduced their lock up to 78 days in a matter of two years. How could they do it?

Different approaches have been used. An imaginative approach came from a firm in Atlanta, GA. They implemented a policy whereby lawyers would be paid a princely sum of $7 a day if they submitted each day’s time by 10 am the next morning. The firm’s accountant stated: “You would be amazed at what lawyers will do for $7 a day”.

Other approaches: E-billing systems check time for date worked vs date recorded: If too long a lag, the time may not be accepted. Others watch hours recorded by day – and monitor for timekeepers attempting to game the system with time reversals.

The results on profit and working capital are clear in the numbers. Just a five day decrease in lock up increases PPEP [profit per equity partner] by over 2%.

Here are recommendations to reduce lock-up:

- Cash is King: Evaluate partners on cash collections as opposed to hours worked or billings. Link profit to cash collected, not accrual accounting.

- Determine client profit based on collections: Partners do not get credit for work done until it is collected.

- Timely Billing: Bill frequently and at time(s) where results were achieved (see the “graph of gratitude”). Bill half your clients in the first two weeks of the month and the others in the last two weeks.

- Measure the Right Indicators: Billing rate and billable hours are not the best metrics for monitoring conversion and velocity: Billable hours and billing rates are too early in the work-to-cash continuum to be meaningful. Instead, focus on collected rates and cash collections, and tie evaluations and incentives to these targets.

- Stop Work: Monitor lock-up and have a senior partner follow up with partners with delinquent clients: stop existing work, and cease taking on new matters.

- Draws: Link draws to cash management – this has been suggested many times rarely implemented.

- Engagement Letters: Use on all matters, incorporating billing and collection terms. Consider Evergreen retainers when appropriate.

- Get Timely Information: Move to real-time reporting vs. printed reports that are outdated almost immediately.

- Cut out the Speed Bumps: Client account audits slow down the collection cycle; ensure that e-bill accounts are audit-proof. There are real-time time capture tools that are very effective in ensuring client guidelines are met.

Conclusion

Working Smarter and not Harder is a well-worn maxim. Today, by following the RULES and employing effective technology tools and informative analytics, we can achieve greater profit without flogging associates to death with their billable hour requirements.

Appendix: Time Management Best Practices:

Not wishing to appear tone deaf that associates feel they are overtaxed already, the following recommendations do not suggest that timekeepers should work more hours – only that they convert more of the time they have already worked to recoverable time by following proven strategies. This further detail implements Bob Arndt’s Utilization principle and assists in reducing the time leaks noted above.

Keep track of Time Spent on All Tasks (billable and non-billable):

You need to know where you spend your time – billable and non-billable. You can see which are the unproductive time wasters and concentrate on your productive tasks. Today there are technological tools that will highlight time wasting activities.

Create a To-Do list for Tomorrow at the end of today:

Create your to-do list at the end of the day by recording all the things you need to accomplish while they are in your head. You know what you have to do tomorrow.

Identify Your Daily, Weekly and Monthly Goals:

Write down what goals you wish to accomplish by the end of the day, the end of the week and the end of the month. Listing them helps you stay on task when interruptions and distractions arise.

Prioritize Tasks:

Time management is partly developing the ability to discern what needs to be done from the rest and then doing it – promptly.

Create a To-Do list and sort your tasks into four categories:

- Important and Urgent: Do these First – they are the most important work to be done today.

- Important but not Urgent – Make room for these…they are longer term goals; schedule them into your day after the important and urgent tasks.

- Urgent but not Important – These are Time Sinks… schedule them low in priority

- Neither Important nor Urgent – Put on the Never Never list – they are not taking you towards any of your goals.

Stop Procrastinating (Today not Tomorrow!):

There are many reasons for avoiding a task, none of them good. You may be avoiding something unpleasant, time consuming or fearing failure. Failing to face up and deal with these only makes them worse. Break a large task into smaller ones. Do the most unpleasant task first. Delegate an unpleasant task (remember to return the favour in the future).

Stop being a Perfectionist:

Perfection is the enemy of task accomplishment. The 80/20 rule – 20% of your tasks will take 80% of your time. Squeeze time burners into a time budget and do them as quickly as possible. Remember “satisficing: Pursuing a course of action satisfying the minimum requirements to achieve a goal.” Send your results to the delegator asking if they wish more work to be done.

Stop Burnout by doing the Important & Urgent things today:

All of us have a ‘most productive’ time of the day. Match that time with your most important and urgent tasks and use your best energy for your most important tasks.

Seek a Time Management Mentor (Someone with good time management skills):

Mentoring is one of the benefits of working in a large firm. Find a partner who is willing to take you under his/her wing and teach you what they know.

Ask assigning Partner for a Billable Hours Goal for a Task (keep assignments on budget):

When someone assigns a task, ask “How much time do you want me to put into this before we sit down for a review?” You both establish a block of time and a deadline for the task and avoid ‘project creep’.

Take Short Breaks after each task completion:

Reward positive behavior for task accomplishment. Enjoy a short break and allow your brain to refresh.

Block off Time to Achieve Tasks in your Calendar (keep 20% time uncommitted):

Take your tasks and establish a time budget for each (hopefully with the delegator). When you run up to your time budget, re-evaluate what needs to be done and discuss with the delegator.

Limit Distractions and Interruptions:

Interruptions are a factor of life such as email. Squeeze email into three time slots (9 am, 1 pm and 5 pm) and for a fixed amount of time (20 mins).

Work from a clean desk (clutter free desk):

Clutter is a distraction and a sign of disorganization. Work from to-do lists and get the papers off your desk.

Stick to a Routine:

A routine allows you control of your life, time and tasks and structure your time to best use. You set aside the time for all the things you need to do in a certain order and priority.

Estimate how long it will take you to complete a task and compare your time against your estimate.

Break Complex Tasks into Smaller, Manageable bites:

Break bigger tasks into bite-sized chunks and allocate those to your time schedule.

Delegate if at all possible:

Delegate tasks to the lowest common competent person who can accomplish them. This will develop the skill of task management and supervision and allow you to use your time for the most important and urgent tasks in your day rather than routine matters.

None of these suggestions require a timekeeper to work more hours; this is all newfound income that goes straight to the bottom line by eliminating leaks from the billable hour boat.

One thing is clear. By paying attention to and tweaking the R.U.L.E.S., we can increase profitability, increase both associate retention and satisfaction and win the game of work – life balance. You will be remembered by your associates and partners for everything you do for them.

—

Bios:

Steven Campbell:

Steven Campbell is a Consultant with Acumen Consulting, LLC. He helps law firms develop strategies to improve performance, leveraging innovative analytics and his extensive law firm experience to provide insight and clarity.

With over 25 years of experience in AmLaw COO and law firm consulting roles (including Thomson Reuters Elite’s Business Intelligence team), Steven has been a pioneer in data-driven profitability analysis and performance management in law firms.

Steven’s deep understanding of law firm operations and challenges has enabled him to partner with firms to successfully design and implement data-driven strategies with enthusiastic adoption, achieving significant transformational results and enhancing both firm profitability and client value. You can contact him at: Steven@AcumenKPI.com and phone 313 580 0468.

David J. Bilinsky:

David J. Bilinsky is considered a visionary in how technology and other forces are changing the practice of law and how legal organizations can take advantage of these changes.

As the Practice Management Advisor and lawyer for the Law Society of British Columbia for 20 years he advised lawyers on ethics, practice management, and technology. He is a Fellow of the National Center for Technology and Dispute Resolution (NCTDR) at the University of Massachusetts and a Fellow of the College of Law Practice Management. He is the co-chair of the Law Firm Finance Board for the ABA’s Law Practice Division and past ABA TECHSHOW co-chair. He currently is the principal of Thoughtful Legal Management, a legal practice management consulting firm. You can contact him at daveb@thoughtfullaw.com and phone 778 697 7110.

[1] To November 2021

[2] Assuming a firm that had a 30% margin before the recovery of lost time, a 3.7% revenue increase translates into an 11.1% profit improvement.