♫ Can’t pay tax

Won’t pay tax..♫

Lyrics, music and recorded by Chaos UK.

Well the HST on legal services is now a reality in BC and in Ontario.

The CRA’s publication:

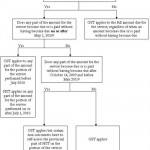

Ontario and British Columbia: Transition to the Harmonized Sales Tax – Services has the displayed flowchart in Appendix A – Transitional rules for services.

A PDF version of this diagram can be downloaded here: HST Flowchart PDF

This flowchart helps clarify the issue as to when HST or GST (and PST for those in BC) applies to legal services. The publication is: http://www.cra-arc.gc.ca/E/pub/gi/gi-056/gi-056-e.html

Three other publications from CRA are of particular interest. They are:

P-206 Litigation Services Supplied to Non-Resident Individuals

and:

as well as:

Regarding HST on Medical-Legal Reports:

GST/HST Policy Statement P-248 governs the tax treatment of IME’s.

There are a number of factors that have to be taken into account such as whether the supply was rendered in a “health care facility” or is an “institutional health care service”; whether the facility specializes in the examination of injured individuals and subcontract solely with physicians to perform the examinations and prepare the ensuring expert reports, whether all the services rendered by the physician are provided in the operator’s facility and the like.

The complete list of CRA Forms and Publications are on this web site:

http://www.cra-arc.gc.ca/menu/APAP_P-e.html

The Law Society of British Columbia in conjunction with the Continuing Legal Education Society of British Columbia has issued an FAQ Sheet on the HST:

HST law practice FAQ (PDF)

Of course any lawyer is well-advised to seek the advice of a Chartered Accountant as to the tax treatment of their legal services in any particular situation.

There are still further transition guidelines that are to be issued by the Canada Revenue Service, such as how to treat contingency fees. While the 90/10 Rule noted in this diagram provides some guidance, in my experience many lawyers who work on contingency fee matters do not track their billable hours and as such, the 90/10 Rule provides little guidance in their particular circumstances.

While there are always those who can’t or won’t pay taxes, for the rest of us where this is not an option, hopefully these resources will make figuring out the tax a little bit easier..

This entry was posted on Friday, July 2nd, 2010 at 4:24 pm and is filed under Change Management, Firm Governance, Issues facing Law Firms, Tips, Trends. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.